BeMoto Bike Insurance: The Broker That Knows The Difference

Visordown takes a look at the motorcycle insurance specialist that is breaking down some big doors in the UK bike insurance market - BeMoto.

.jpg?width=1600&aspect_ratio=16:9)

SPENDING your hard-earned cash on your motorcycle is, for most riders, the only kind of retail therapy we truly enjoy.

Be it kit to wear when on a track or a trail, or aftermarket parts to improve the bike’s performance or comfort - part of the appeal for many riders are the many ways you can really make your bike your own.

Quite possibly not included on this list of enjoyable ways to spend money on your bike, will be when the time comes to renew your bike insurance policy… it just doesn’t give you that same, warm and fuzzy feeling inside.

Because of this, there can be a tendency to either go with the first quote you see that sits at a price point you like the look of or simply let the policy roll over on an automated renewal. Now imagine that a time comes when your bike is stolen or even written off, and all those aftermarket parts are now gone, with seemingly no way of recovering the money for them?

An Insurer That Actually Loves Mods!

The motorcycle insurance market in the UK is a huge industry, and with more than 1 million bikers currently on the roads, it’s also very competitive. With that high volume of potential new customers though it has become increasingly attractive to large corporations looking to tap into this substantial pot of cash. Many of these big names in the bike insurance world are owned by larger companies, and in many cases, they aren’t going to really get what makes bikers tick.

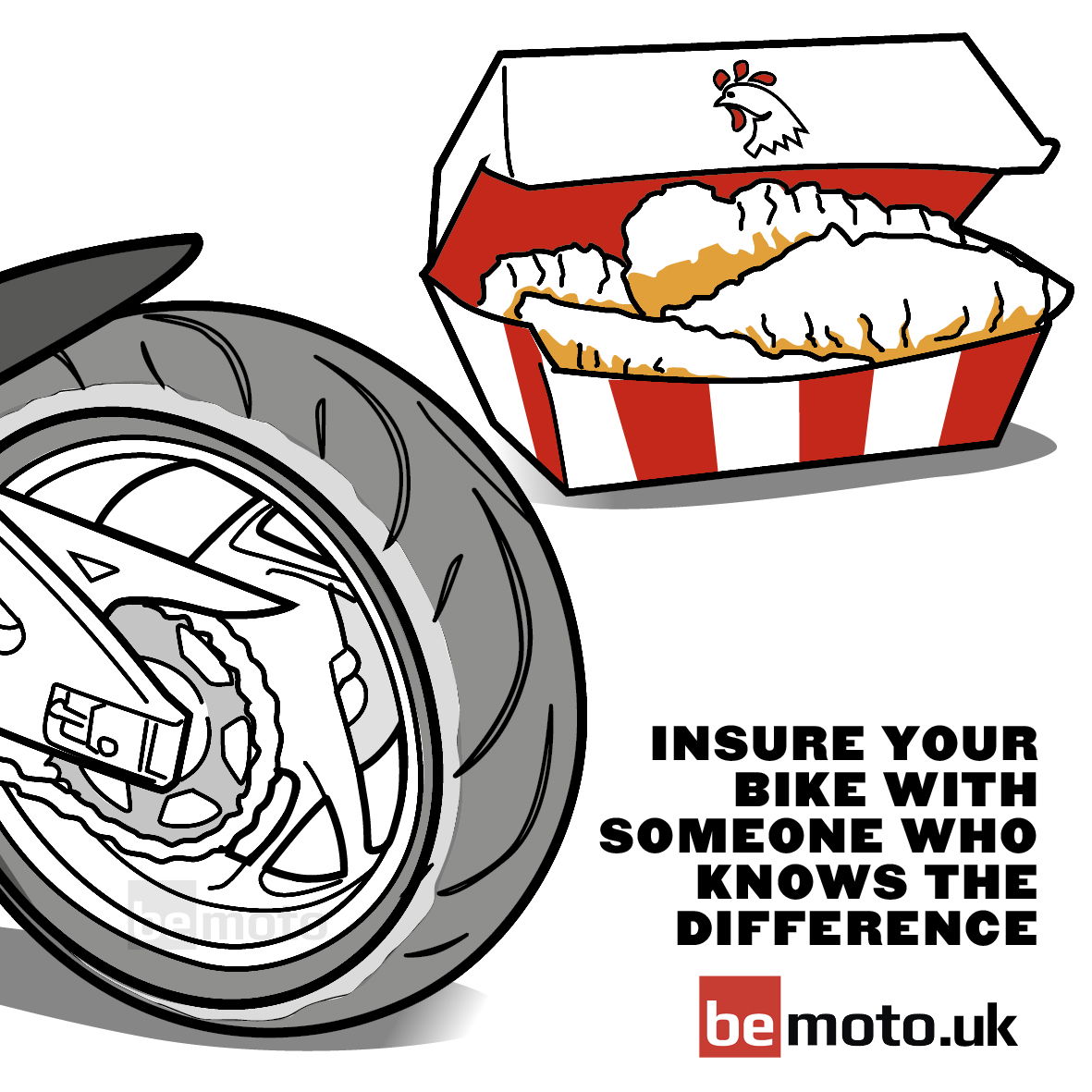

You wouldn’t take your prized motorcycle to a car mechanic for some suspension tweaks, so why buy your bike insurance from a company that also insures houses, pets, holidays and tech?

BeMoto is a relative newcomer to the motorcycle insurance market, having been founded in 2015 by three motorcycle enthusiasts. The head office is based in Peterborough and has a growing team of motorcycle insurance specialists, with no overseas call centre. The company’s founders, two of whom have multi-bike collections and enjoy track days, touring and off-road riding, were motivated to start the business with an initial focus on niche track policies after both had their track-day bikes stolen from their respective home garages. They have since expanded their product range to be one of the widest in the market, with policies designed for bike enthusiasts on road, track, and dirt.

BeMoto prides itself on offering a unique and personalised approach to motorcycle insurance. The company recognises that every biker and their bike is unique and deserving of customised coverage. BeMoto offers a range of insurance products that cater to the diverse needs of bikers, including modified, multi-bike, classics, and scooters. The company also offers fire and theft cover for SORN or non-road legal motorcycles kept in a garage, race van policies, personal accident products for biker injuries, and travel repatriation for bike touring holidays and even track day damage covers.

The jewel in the crown is their approach to multi-bike policies. Often a frustration for many bikers who possess more than one mechanical horse. We hear stories all the time where people struggle to get their whole collection on cover, or at least have to undergo the same amount of effort as splitting the atom to get a collection sorted.

No Admin Fees To Make Changes

One of BeMoto’s unique features is its approach to changes made to a policy mid-term. Unlike their competitors, BeMoto does not charge an amendment fee if you want to make a change to your policy mid-term, such as changing your bike, adding a modification, changing jobs or moving home. You may be familiar with their “No Fees To Make Changes” advertisements that seem to reach every biker on Facebook and have saved their customers an estimated £1m since 2016. It’s no surprise therefore that as of May 2023, 98% of customers on TrustPilot recommend BeMoto!

BeMoto’s founders believe in treating bikers fairly, offering excellent service and a great product at a reasonable price. They understand the passion that bikers have for their motorcycles and the importance of insuring them against potential losses.

Declared Mods Replaced Like For Like

Their approach to making things easy has always been a key ethos for the brand, with EVERY customer renewal being built by hand since day one with a strict aversion to price hiking. BeMoto led the way in saving customers hassle and being fair by valuing new and existing customers equally, even before the FCA outlawed price hiking in 2022. This approach extends into modifications, BeMoto not only covers mods they love them! This is why they reinstate declared modifications in the event of a claim, some competitors only repair a bike back to factory standards. They have a huge list of “accepted modifications” and there is no limit to the number of modifications you can have, frankly you can build a Frankenstein bike from the ground up, they’d still love to cover it. For the tinkerers out there, you can save a fortune when adding or removing mods from your bike because they don’t charge admin fees for declaring the changes! More money to spend on mods!!

The focus that BeMoto places on value doesn’t stop there. Their market-leading Titanium Cover is an absolute bargain! You’ll be familiar with the insurance call, and as soon as you get the price, the agent normally follows with a ream of upsells, and they can add up pretty quickly. BeMoto has a different approach. They have grouped the top-selling add-ons in the industry, matched or beaten the normal offering and grouped them all together as a single bundle at a fantastic price. You can pay as much as £90 for breakdown cover alone with another leading provider. BeMoto offers Full UK & EU RAC breakdown cover (including Home Start), £1,500 protective gear cover (helmets, leathers etc), £15,000 Personal Accident Insurance and £100,000 Legal Expenses Insurance, all for… around £50! Each of the other add-ons can be up to £50 each in other places. Meaning a fair value for the Titanium Cover would be around £200, BeMoto doesn’t even charge half that! Not to mention 90 Day EU Touring Cover (per trip) is included as standard! Oh and did we mention, NO amendment fees…

.jpg?width=1600)

BeMoto is deeply connected to the grassroots of motorcycling, they have close relationships with all your favourite Youtubers, including 44Teeth, Motobob, Lamb Chop Rides, and RichyVida to name a few. They support World Record holding Stunt Champ JD Stunts and even threw their weight behind Davey Todd in his 2022 British Superbikes debut and are continuing in support for 2023.

The BeMoto team spend a lot of time supporting bike events, and not just the big ones, it’s not uncommon to see a BeMoto hoody on the road at your favourite biker destination or a local rally.

R&G Mods Covered As Standard

It's the unique blend of blood enthusiasm and insurance expertise that really makes BeMoto a frontrunner in your consideration for who to insure with. They are constantly looking for ways to make our lives easier. Recently they forged ties with R&G to cover modifications from the crash protection and styling superstars – as standard. You don’t even need to tell BeMoto that you have R&G mods on the bike, just include them in your bike value. If you add R&G mods mid-term, you don’t even have to pick up the phone like you would with everybody else. Result!!

As a privately owned company, BeMoto is committed to building a business that they can be proud of. The company’s founders share their passion for the biker community with customers and partners. BeMoto is still a relatively young business, working to do it right, and the company is always looking for feedback from customers on where they can improve. It’s this focus on feedback that has resulted in those top review scores we mentioned earlier.

.jpg?width=1600)

Full Breakdown, Helmet & Leather Cover, 90 Day Touring Cover, Personal Accident & £100k Legal Expenses for around £50 more!!

In conclusion, BeMoto Bike Insurance is a company that has managed to capture the hearts of the biker community by offering unique and personalised motorcycle insurance policies. With a focus on providing excellent customer service and a range of insurance products to meet the diverse needs of bikers, BeMoto is poised to continue its growth as one of the leading motorcycle insurance providers in the UK.