Storm clouds over LiveWire? Execs selling shares is a troubling sign

LiveWire execs are offloading shares as financial losses mount, raising fresh concerns about the electric motorcycle brand's long-term stability.

There was a flicker of optimism at the start of the week as LiveWire’s stock price climbed pre-market, but the shine didn’t last long. Shares in Harley-Davidson’s electric offshoot opened Monday at $4.11, a modest bump from Friday’s close of $3.86, but it quickly settled back down to $3.96. Hardly the surge of investor confidence you’d hope for in the EV sector’s supposed golden child.

On paper, things don’t look catastrophic just yet. LiveWire holds a market cap just over the billion-dollar mark, with shares hovering near their fifty-day average of $3.89, still up on the longer-term 200-day average of $3.04. But behind the numbers is a more troubling tale, and it starts with the people at the very top.

Execs Heading for the Exit?

In what’s likely to raise eyebrows among investors and motorcyclists alike, LiveWire execs have been offloading stock at a pace that feels less like rebalancing and more like bailing out.

According to the finance website MarketBeat, CEO Karim Donnez cashed out 54,661 shares mid-June, netting over $300k at an average price of $5.50 per share. That move saw his personal stake in the company fall by over 5 per cent, leaving him with just under a million shares. It wasn’t just the top boss, either. Director John L. Garcia let go of over 56,000 shares a few days prior, selling at $6.47 a pop and trimming his holdings by about 2 per cent. Together, insiders have dumped nearly 277,000 shares in the past three months, worth just shy of $2 million.

To the casual observer, it’s a run-of-the-mill reshuffling. To the seasoned investor or the slightly cynical biker, it’s a potential red flag.

Sluggish Sales, Gaping Losses

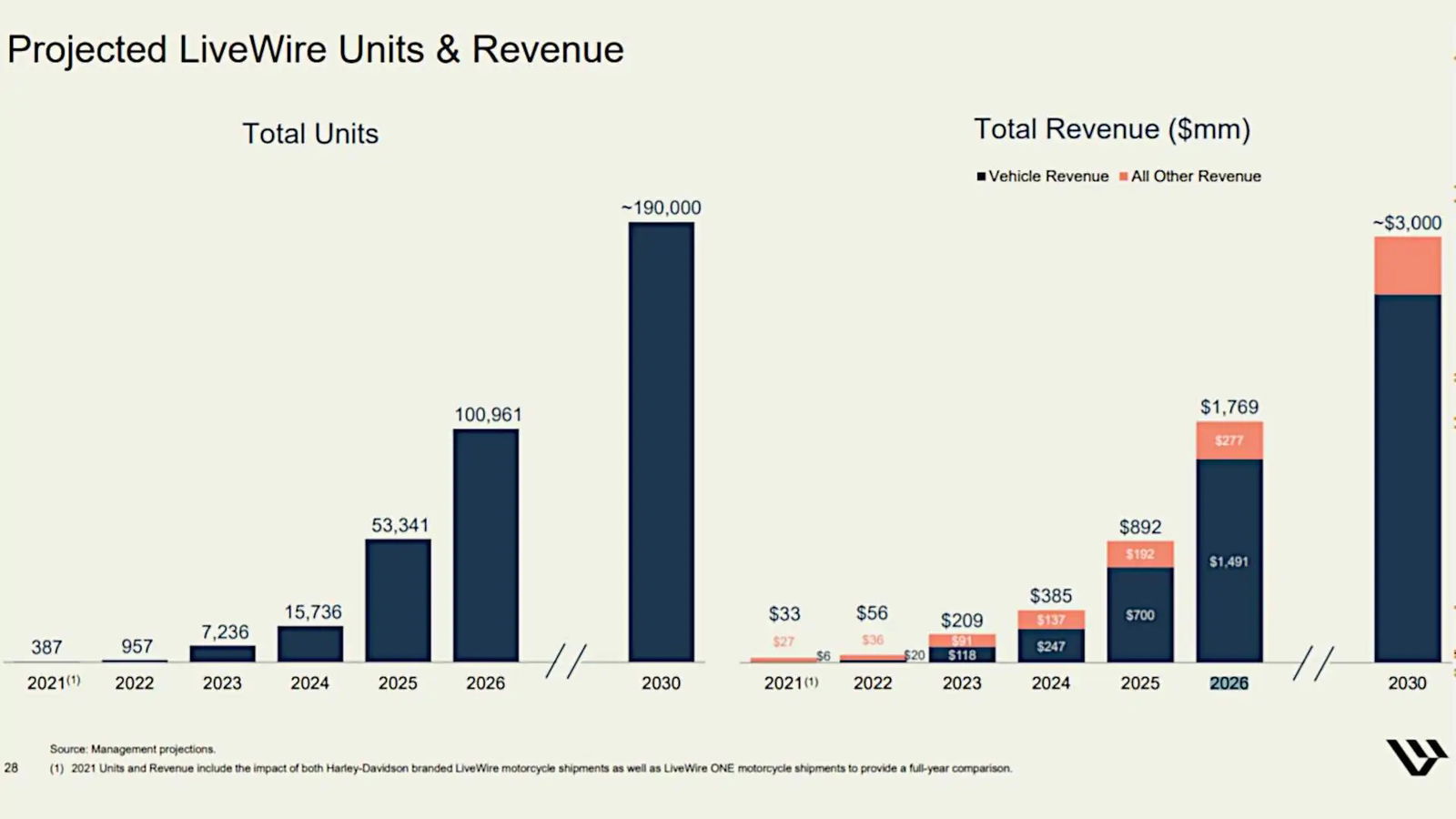

The real kicker? The company’s Q1 earnings report, quietly dropped on May 1st, showed a net loss margin of a staggering -367 per cent. That’s not a typo. For every dollar LiveWire pulled in, it lost more than three. Its return on equity sits deep in the red at -70 per cent. Revenue for the quarter was a paltry $2.74 million, a drop in the ocean compared to what’s needed to turn the brand from boutique curiosity into a genuine market player.

LiveWire’s P/E ratio (a valuation metric that compares a company's stock price to its earnings per share) sits in negative territory at -11.78, and while the beta of 1.71 suggests volatility (read: excitement for short-term traders), it also indicates just how risky this stock has become.

Growing Pains or Warning Signs?

It’s not all doom and gloom yet, though. LiveWire’s recent models, like the S2 Del Mar and Mullholland and Alpinista, have been generally well received, at least from a design and performance standpoint. But the electric motorcycle market remains an uphill battle, with high price tags, a lack of charging infrastructure in some regions, and a hesitant customer base all slowing adoption.

Harley-Davidson’s decision to spin off LiveWire was meant to let the brand innovate without the burden of legacy baggage, and for the most part, it worked. The S2 platform, which gave us LiveWire's three new models as a standalone brand, were all very good, with the S2 Del Mar looking like one of the best electric bikes in recent years. But with top brass cashing out and financials in the red, you have to wonder: are we witnessing the awkward adolescence of a future success story, or are the wheels already starting to wobble?

You may like to check out our LiveWire S2 Del Mar review.

The next few quarters will be crucial. A strong sales push or meaningful tech development could turn the tide, but for now, investors (and riders) might do well to keep one hand hovering over the clutch. Just in case.

Find the latest motorcycle news on Visordown.com.