European motorcycle industry shrinks in first half of 2022

The European motorcycle market remained mostly stable, but shrank slightly in the first half of 2022, new figures reveal.

The European motorcycle market has slightly shrank in the first half of 2022, despite a promising first quarter of the year.

After 2020’s Covid-induced slump for the motorcycle market - as well as most consumer markets - there was a strong rebound in 2021. Despite 2022 beginning by continuing in a similar vein, the first half of the year has seen a slight decrease in the market.

The European Association of Motorcycle Manufacturers (ACEM) reports a growth in some of the major European markets in the first half of 2022, and a reduction in others.

The markets in Germany and Spain, for example, both grew; in Germany by 1.7% and in Spain by 10.7%.

On the other hand, France, Italy, and the UK saw their markets shrink by 6.4%, 2.8%, and 2.3% respectively in the first half of the year.

This had led to an overall market reduction of 0.5% among the five major motorcycle markets in Europe in the first half of 2022 compared to the first half of 2021.

There are a variety of reasons for this, from the ongoing economic effects of the Covid pandemic, to the global economic and industrial effects of the Russo-Ukrainian conflict, as well as the global drought that has been suffered this summer, and which continues to have a major presence in major European countries, as well as in other major nations such as China.

The results of these things has been an overall rise in the cost of living for people across the world, and of course Europe is included in that. It now costs more to live than it did last year, but people are not necessarily being paid more to accommodate that, and that reality is only set to intensify in the coming months.

People are therefore less inclined to spend their money on a motorcycle than they were at the start of this year, or in the first half of last year. In addition to that is the effect of the price of fuel on the desire for people to buy combustion motorcycles. If you have, overall, less money, spending that money on a motorcycle that then requires more money to be spent on fuelling it than was required a year ago becomes unappealing. This is of course not the case for everyone, but also not for just a few.

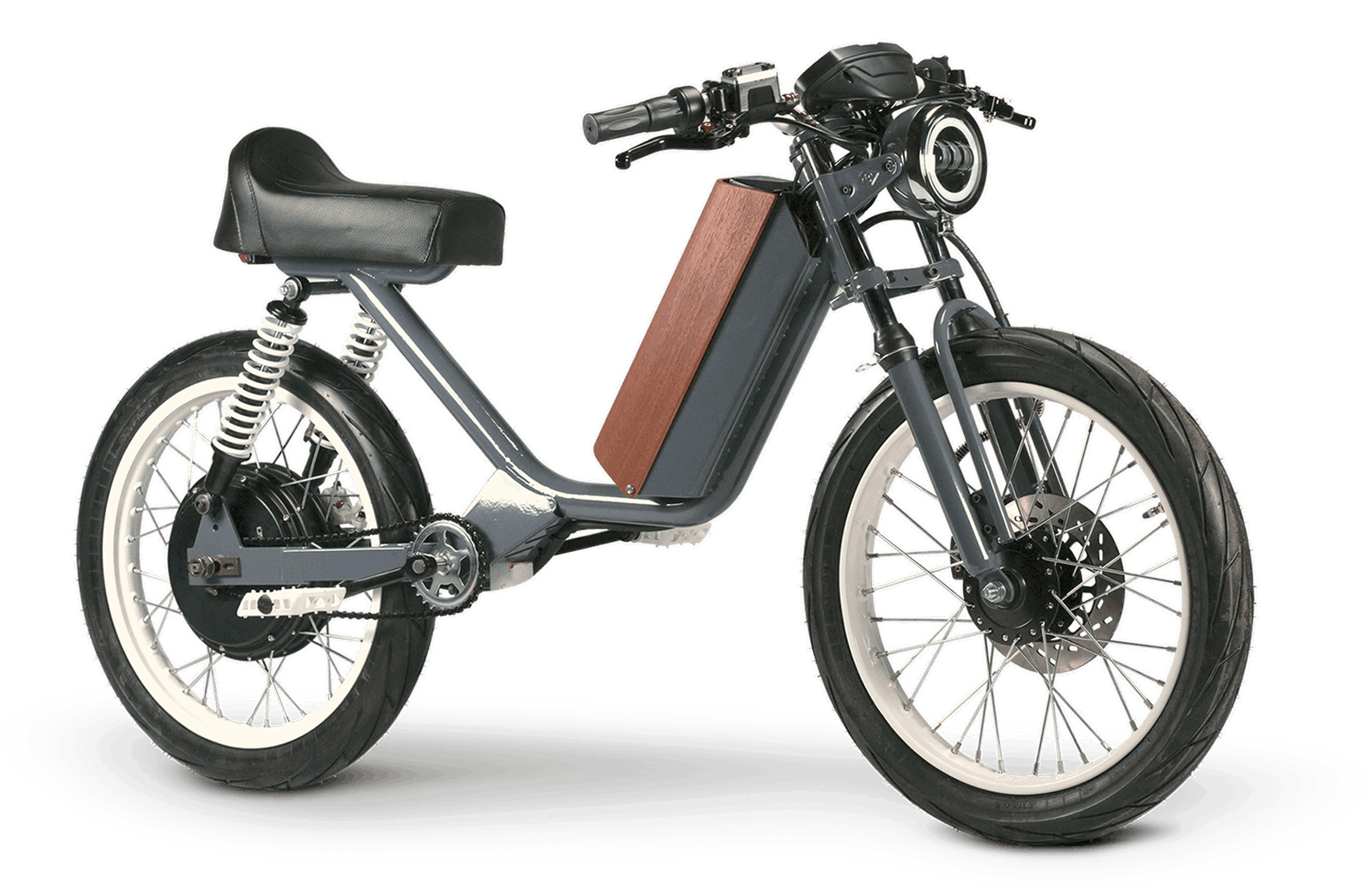

In comparison to the motorcycle market, the moped market grew overall in the first half of 2022 compared to the first half of 2021 by one per cent. Perhaps this shows the direction the general two-wheeler market needs to head in as people become net-poorer. Mopeds are some of the more practical two-wheelers out there, and are also more straightforward to convert to electric power, even retroactively.

ACEM Secretary General Antonio Perlot said: “In recent months, two-wheeler sales have been affected by logistic disruptions at international level. This led to a backlog in vehicle deliveries in several European markets. Sales were also affected by rising energy costs and inflation, higher interest rates and broad economic uncertainty.

“That said, registrations for mopeds and motorcycles in Europe remained stable in comparison to the first half of 2021. Due to their relatively low purchasing and running costs, two-wheelers have fared much better than other private means of transport.

“We will know whether 2022 was a good year for our sector, when the aggregated figures for the first nine months of the year become available.”